Bloomberg certification offered at Dallas College

Angel Marcial, Staff Writer

| March 19, 2024

Start tax season out on the right foot

Angel Marcial, Staff Writer

| March 12, 2024

Tax season is here: Next steps

Blanca Reyes, Editor-in-Chief

| April 17, 2023

ONLINE ONLY: Fed raises prime rate a third time

October 21, 2022

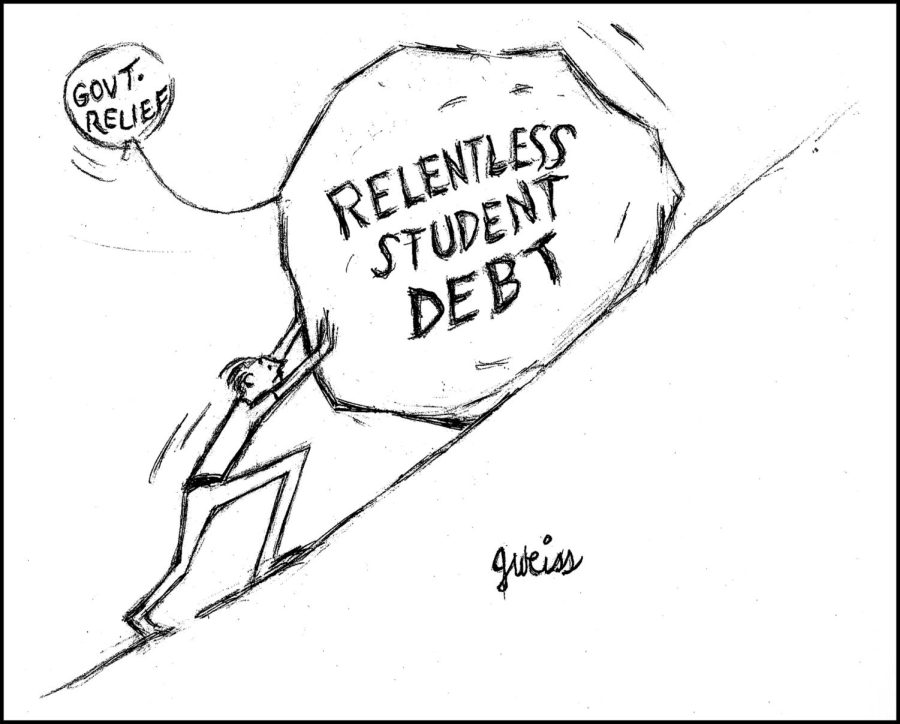

Student loan forgiveness: Yay or nay?

October 3, 2022

Campus thoughts on student loan forgiveness plan

Ryan Bingham Duff, Staff Writer

| September 13, 2022

Economic frustrations as the Russian-Ukraine war rages on

Alex Ortuno, Managing Editor

| March 23, 2022

Growing loan debt threatens students’ future

Cade Harris, Staff Writer

| March 12, 2022

Load More Stories

Dallas

-

5 PM67 °

-

6 PM65 °

-

7 PM64 °

-

8 PM63 °

-

9 PM62 °

-

10 PM61 °

-

11 PM61 °

-

12 AM61 °

-

1 AM60 °

-

2 AM60 °

-

3 AM59 °

-

4 AM59 °

-

5 AM58 °

-

6 AM58 °

-

7 AM58 °

-

8 AM57 °

-

9 AM57 °

-

10 AM56 °

-

11 AM55 °

-

12 PM54 °

-

1 PM54 °

-

2 PM53 °

-

3 PM53 °

-

4 PM53 °

-

5 PM51 °

April 19

70°/

55°

Patchy rain nearby

April 20

58°/

47°

Moderate rain

April 21

62°/

47°

Patchy rain nearby